In recent years, Bitcoin has become a focal point for investors, financial analysts, and everyday consumers alike. As the first and most well-known cryptocurrency, Bitcoin's price volatility has raised questions about its long-term viability and stability. With numerous predictions circulating regarding whether Bitcoin is going to crash, it's crucial to delve into the factors influencing its performance and the broader cryptocurrency market.

In this article, we will explore the key elements that contribute to the rise and fall of Bitcoin, analyze expert opinions, and provide insights into what the future might hold for this digital currency. Understanding these dynamics is essential for anyone looking to navigate the world of cryptocurrency safely and responsibly.

Ultimately, whether you are an investor, a tech enthusiast, or simply curious about Bitcoin, this comprehensive analysis aims to equip you with the knowledge you need to make informed decisions. Let's begin our exploration of the potential crash of Bitcoin and the various factors at play in the cryptocurrency landscape.

Table of Contents

- 1. What is Bitcoin?

- 2. Historical Price Trends

- 3. Factors Influencing Bitcoin Prices

- 4. Expert Predictions

- 5. Potential Risks and Challenges

- 6. The Role of Regulation

- 7. Future Outlook for Bitcoin

- 8. Conclusion

1. What is Bitcoin?

Bitcoin is a decentralized digital currency that was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Unlike traditional currencies, Bitcoin operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers. This ensures transparency and security, making it difficult to manipulate or counterfeit Bitcoin.

Bitcoin can be used for various transactions, including online purchases, investments, and remittances. Its unique features, such as limited supply (capped at 21 million coins) and the ability to bypass traditional financial intermediaries, have contributed to its popularity and adoption.

2. Historical Price Trends

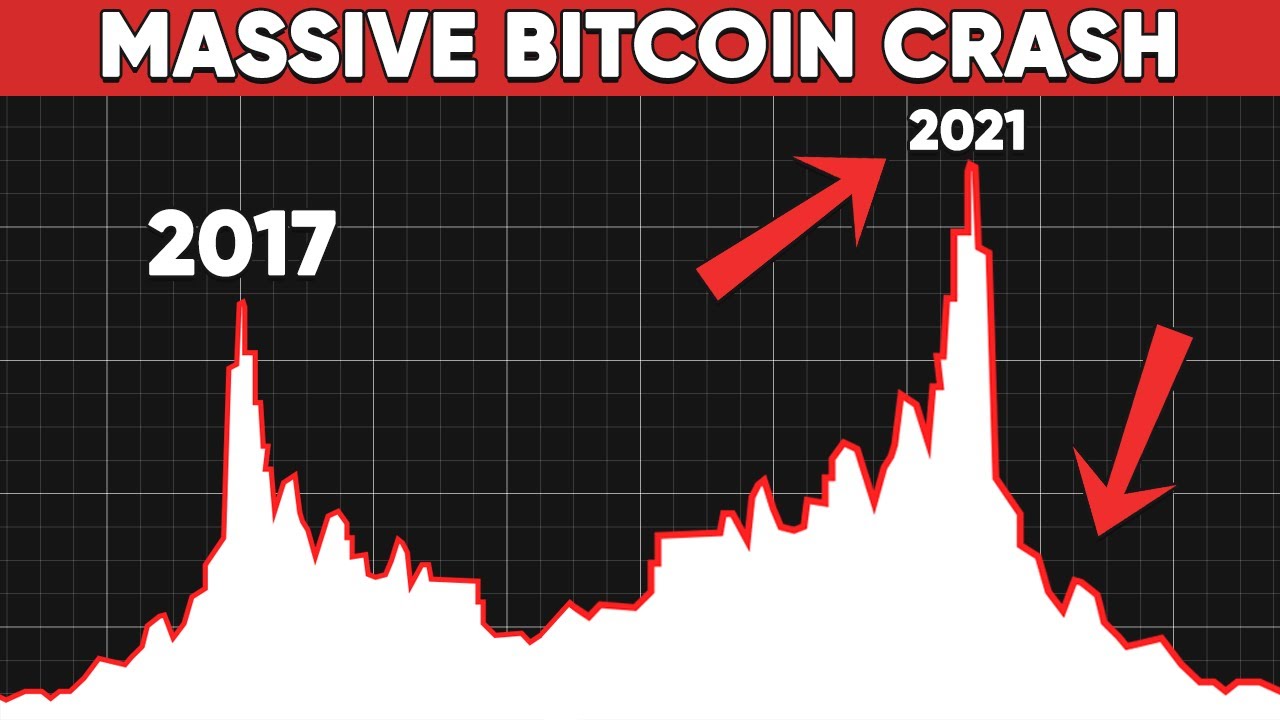

To understand whether Bitcoin is going to crash, it's essential to analyze its historical price trends. Since its inception, Bitcoin has experienced significant price fluctuations. Here are some key milestones:

- In 2010, Bitcoin was valued at less than $0.01.

- By the end of 2013, Bitcoin reached a peak of over $1,000.

- In late 2017, Bitcoin hit an all-time high of nearly $20,000.

- In March 2020, during the COVID-19 pandemic, Bitcoin plummeted to around $4,000.

- In late 2021, Bitcoin surged again, reaching a new high of approximately $64,000.

These price movements highlight Bitcoin's inherent volatility, which can be both an opportunity and a risk for investors.

3. Factors Influencing Bitcoin Prices

Several factors can influence Bitcoin prices, including:

3.1 Market Demand and Supply

The basic economic principle of supply and demand plays a crucial role in Bitcoin's price. As demand for Bitcoin increases, its price tends to rise, and vice versa. Limited supply, due to the fixed cap of 21 million coins, can lead to increased prices during periods of high demand.

3.2 Investor Sentiment

Investor sentiment can greatly impact Bitcoin's price. Positive news, such as institutional adoption or regulatory clarity, often leads to price increases, while negative news, such as hacks or regulatory crackdowns, can trigger sell-offs.

3.3 Technological Developments

Technological advancements in the blockchain space can influence Bitcoin's perceived value. Innovations that enhance security, scalability, and usability may foster confidence among investors, while technical issues could lead to concerns about stability.

4. Expert Predictions

Experts and analysts have varying opinions on whether Bitcoin is going to crash. Some believe that Bitcoin's fundamentals are strong enough to sustain long-term growth, while others caution against potential downturns. Key predictions include:

- Some analysts predict Bitcoin could reach $100,000 within the next few years, driven by increased adoption and institutional investment.

- Others warn of a potential crash, citing historical patterns of boom and bust cycles.

- A few experts suggest that Bitcoin may stabilize into a more predictable asset class as it matures.

5. Potential Risks and Challenges

Investing in Bitcoin comes with inherent risks and challenges, such as:

5.1 Market Volatility

Bitcoin's price is notoriously volatile, which can lead to significant financial losses for investors who enter the market at the wrong time.

5.2 Regulatory Uncertainty

Governments and regulatory bodies across the globe are still grappling with how to regulate cryptocurrencies. Changes in regulations can impact market confidence and prices.

5.3 Security Concerns

While blockchain technology is secure, exchanges and wallets can be vulnerable to hacks, leading to potential losses for investors.

6. The Role of Regulation

Regulatory developments can significantly impact Bitcoin's market dynamics. While some regulations may enhance security and trust, others could stifle innovation and limit market access. Key considerations include:

- Governments are increasingly implementing regulations to combat money laundering and fraud.

- Some countries have embraced cryptocurrencies, while others have imposed strict bans.

- Regulatory clarity may encourage institutional investment, positively influencing Bitcoin's price.

7. Future Outlook for Bitcoin

The future outlook for Bitcoin remains uncertain but intriguing. Factors such as growing institutional adoption, technological advancements, and regulatory developments will play a crucial role in shaping Bitcoin's trajectory. Many experts believe that Bitcoin's resilience and unique properties position it as a long-term store of value, akin to digital gold.

8. Conclusion

In summary, whether Bitcoin is going to crash is influenced by a myriad of factors, from market demand and investor sentiment to regulatory developments. While the potential for significant price fluctuations exists, Bitcoin's unique attributes and growing acceptance may contribute to its longevity. As with any investment, it is essential to conduct thorough research and consider your risk tolerance before entering the cryptocurrency market.

We invite you to share your thoughts on Bitcoin's future in the comments section below and encourage you to explore more articles on cryptocurrency to stay informed about this rapidly evolving landscape.

Thank you for reading, and we hope to see you back on our site for more engaging content!